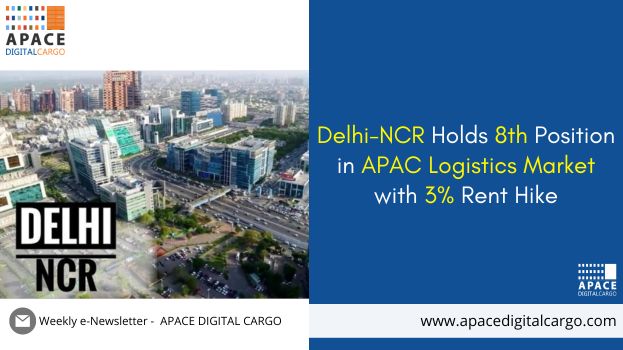

The surge in e-commerce startups and import-export activities has been notable, but recent geopolitical tensions have disrupted supply chains and affected the valuations of commercial real estate associated with these sectors. According to a report by Knight Frank, the logistics market in the Asia-Pacific (APAC) region experienced a modest annual rent growth of 2.4% from January to June 2024 (H1 2024). This marks a significant decrease compared to the 6.2% growth seen in H1 2023. However, the Indian markets are rapidly climbing the rankings. Delhi-NCR now holds the 8th position out of 13 cities in the APAC logistics market for annual rent growth.

In the national capital region, Delhi-NCR, rental rates have increased by 3% year-over-year, the highest among the major markets of Mumbai and Bengaluru. Mumbai reported a 2.3% growth in rental rates, while Bengaluru also saw a 2.3% increase. The outlook for the next six months remains promising for the entire country.

Delhi-NCR’s rent grew to Rs 20.80 per square foot per month with a 15.7% vacancy rate. Mumbai secured the 11th spot with a 2.3% annual rental growth and a reduction in vacancy to 9.4% from 10.3% the previous year. Bengaluru, ranking 12th, saw a 2.3% increase in rent to Rs 22 per square foot per month, with a vacancy rate of 21.1%.

Despite a slowdown in occupier activity, Indian warehousing market rents have shown consistent growth since the pandemic, driven by increased demand in FY 2023. Rent growth in Bengaluru, Mumbai, and Delhi-NCR in H1 2024 has remained steady compared to the previous year.

Shishir Baijal, Chairman and Managing Director of Knight Frank India, commented, “The government’s focus on the manufacturing sector is proving successful, leading to strong demand from this sector. This, combined with the traditional role of 3PL players, has bolstered overall market volumes.”